This function enables you to manage the FX transactions of two currencies at the spot rate, two days after the negotiation date.

It also enables you to view the first leg of a spot/forward swap transaction.

- In the Modules Tasks pane, select the Spot Exchange option in the Management folder of the FX module.

The modification page of the default filter for this function, is displayed.

This page enables you to define filtering criteria restricting or enlarging the selection of transactions to display in the transactions page. If no filter is defined here, all the existing transactions are displayed on the page. If the number of transactions is too large, restricting the selection improves the legibility.

Info

For the description of this page's fields, see the topic below explaining filters creation.

- Set up the filter, then click OK.

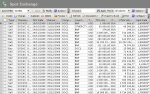

The management page for Spot Exchange Transactions is displayed with the list of the created transactions in a table.

This table presents the list of the spot exchange transactions with, to name a few, the direction, the type, the number and amount of the transaction, the countervalue, the transaction and delivery dates, the company, the counterparty and the spot exchange rate.

For more information on:

- reorganizing the lines in the table, click here

- how to search text in the table, click here

- creating and duplicating transactions, see the topic below,

- modifying transactions, click here,

- deleting transactions, click here,

- back office validation of transactions, see topic Back-office Processing,

- editing transaction-related documents, see topic Transaction-related Documents,

- displaying the cash flows linked to a transaction in the Cash Ledger, see topic Cash Ledger.

Info

It also enables you to view the first leg of a spot/forward swap transaction, but you cannot modify it. You need to use the management function for Swap Transactions to modify the leg of a swap transaction.

You can change the layout of the table: selecting columns, filtering displayed information, grouping lines according to data, etc. For more information on this feature, see topic Table Reorganization.

- In the setup page for Spot Exchange Transactions, click the Create button.

The creation page is displayed.

The header presents the basic information of the transaction.

- Complete the fields of the header.

In the following table, the green ticks in the M column indicate that the fields are mandatory.

The red crosses in the E column indicate the fields that cannot be modified once the transaction is saved.

The Characteristics tab enables you to define the main information on the transaction to create.

- Complete the fields of the tab.

In the following table, the green ticks in the M column indicate that the fields are mandatory.

The red crosses in the E column indicate the fields that cannot be modified once the transaction is saved.

- Click on the Cross Rate tab.

This tab enables you to define the different cross rates when none of the currencies of the FX transaction corresponds to the local currency of the company. It includes the rates for two currencies according to the local currency of the company and to the transaction date.

Your company uses the euro as its local currency and you are concluding a transaction in dollars against pounds sterling.

- The dollar/pound rate (or the reverse) is specified in the Characteristics tab.

- The dollar/euro and euro/pound (or the reverse) are specified in the Cross rate tab.

These rates against the local currency are used to calculate amounts in the local currency, for instance. These calculations are required for the positions or the results: average rate, revaluation, breakeven point, results, etc.

- In the Cross 1 or Cross 2 areas, if needed, you can modify the value of one of the two spot exchange rates.

The value of the other rate is calculated according to the value that you modified and to the cross rate value.

- Click the button

if you want to change the direction of the quotation, as described previously.

if you want to change the direction of the quotation, as described previously.

- Click on the Settlement tab.

The Settlement tab enables you to specify the bank details required for the funds transfers.

As regards spot exchange transactions, there is no actual settlement, as the transactions are simulatneously settled and validated. The delivery comes so quickly (currencies must be delivered at D+2 days) that the transaction is automatically settled during its creation. The spot exchange amounts are not included in the global position, but directly into the stock, that can be viewed in the detailed position.

For the spot exchange transactions, the Settlement tab deals exclusively with the bank details required for the funds transfers. These bank details must be entered when the transaction itself is entered, otherwise the transaction validation is refused. They are used in the mails generated by this transaction.

For more information on Confirmation and Payment Letters, see topic Transaction-related Documents.

- The Main Currency area enables the selection of the accounts for the main currency that will be credited for a buy or debited for a sell.

- The Ctrv Currency area enables the selection of the accounts for the countervalue currency that will be credited for a sell or debited for a buy.

In the following table, the green ticks in the M column indicate that the fields are mandatory.

In the following table, the green ticks in the E column indicate that the fields are editable.

This tab enables you to define additional information on the transaction in a small text.

- In the first field, enter the notes that you want to include in the ledger.

- In the second one, enter the notes that you want to include in the dealing ticket.

- Click OK to validate the creation or Cancel to cancel it.

Two flows are generated in the Treasury: a receipt flow in the main currency and a disbursement flow in the countervalue currency.

- In the management page for Spot Exchange Transactions, enable the option corresponding to the transaction to duplicate, then click Duplicate.

The duplication page for filters is displayed.

The Number field shows the number of the original transaction. The number of the new transaction does not appear here and will be generated by automatic incrementation.

The type of transaction is shown in the Transaction field.

- If you want to change the transaction type:

- Click the button

next to the Transaction field.

- In the contextual window, click the

button to display the list of available transaction types.

button to display the list of available transaction types. - In this list, double-click a line to select it.

The code and description of the selected transaction type, are displayed in the Transaction field.

The Company field shows the code and description of the applicant. This field cannot be edited.

- In the Duplication Type area, enable the following option:

- Initial Characteristics to duplicate all the information elements of the original transaction, including dates and exchange rates,

- Initial characteristics with updated dates and rates, to duplicate all information elements but the dates and exchange rates completed in the way explained below.

- The transaction is set to today's date.

- The delivery date is set to today's date plus two worked days depending on the broker calendar.

- The spot exchange rate is defined on the basis of the bid/ask rates set up in the Market Data module. For more information on the setup of market rates, see Market Data documentation.

- In the actions toolbar, click OK to validate the duplication or Cancel to cancel it.

The management page for Spot Exchange Transactions is redisplayed and updated with the duplicated transaction.

You can then modify the various characteristics of the transaction before its back-office validation.

To access the creation page for filters from the management page of the Spot ExchangeTransactions, click the Actions dropdown menu in the filters toolbar, and select the Add option.

The creation page for filters is displayed.

This page enables the definition of unique identification information for the filter.

- Enter a code and a description for the filter in the Code and Description fields.

- If you want this filter to be applied by default when you access the management page for Spot Exchange Transactions, enable the Template Default Filter option.

- If you want this filter to be only accessible by yourself, select the Private option.

- You may add a comment in the Text area.

- Click the Configure button to set up the filter settings.

The configuration page for filter settings is displayed.

If you want to copy the settings of an existing filter, click the Copy From button in the action bar. Click here for more information.

The filter settings are all optional: complete the ones for which you want to apply filtering criteria.

The General tab enables you to specify a filtering process on different elements: transaction date, delivery date, company, counterparty, currencies, transaction type, file number, portfolio number, transaction direction, back-office validation.

- In the Period area, if you want to specify a filtering process on the transaction date, go through the following process.

- Enable the TRX Date option.

Info

Disable this option if you want to disable the filtering process on the transaction date.

The From and To fields of the area are enabled.

- In these fields, specify the start and end dates of the period in which must fall the transaction date of the transactions to display, by going through the following process:

- In the entry field, select the value to modify and enter a date with the format dd.mm.yyyy.

- or -

- Click the

button to display the calendar.

button to display the calendar.

A contextual window displays the calendar.

Use the arrows  and

and  to select the month, year and day.

to select the month, year and day.

- or -

To set the start date to today's date, click the button Today.

- To specify a filtering process on the delivery date, enable the Delivery Date option, then go through the same process as above, to define the start and end dates of the period in which must fall the delivery date for the transactions to display.

Info

Disable this option if you want to disable the filtering process on the delivery date.

- In the General area, to filter on one of the following elements, use the button

as explained previously:

| Field | Description |

|---|---|

| Company | Applicant (Company) |

| Counterparty | Counterparty with which the transaction is concluded |

| CCY Main | Main currency of the transaction |

| CCY CTRV | Countervalue currency of the transaction |

| Transaction | Transaction Type |

| Folder | Number of the file in which the transaction is included |

| Portfolio | Number of the portfolio in which the transaction is included |

- In the Buy/Sell dropdown list, select a filtering criterion on the direction of the transaction:

- Buy to select the buy transactions only,

- Sell to select the sell transactions only,

- Buy & Sell to disable any filtering process on the transaction direction.

- In the BO Validation dropdown list, select one filtering criterion on the back-office validation of the transactions:

- Non B.O. Validated to select the non back-office validated transactions only,

- B.O. Validated to select the BO-validated transactions only,

- B.O. Validated and Non B.O. Validated to disable any filtering process on the back-office validation.

- Click on the Advanced tab.

This tab enables you to define the filtering criteria on transaction numbers, reference numbers, link numbers, statuses and the transactions using the opposite currency pair.

- In the Number field of the Transaction area, enter a range of order numbers for the transaction.

Important

They are not the complete numbers of the transaction, but the numbers of the creation order, they can be found on the right of the transactions numbers. The transaction number consists of the company code, the transaction type code and the transaction order number.

- In the Reference field, enter the external reference number for the transaction.

- In the Link No field, enter a range of link numbers for the transactions.

- In the Nature area, enable the options corresponding to the transaction statuses that you want to view:

- Initial to select only the initial transactions (manual creations),

- Exercising to select only the transactions created after the early exercise of forward exchange transactions,

- Deferring to select only the transactions created after the deferment of forward exchange transactions,

- Swap to select only the transactions that are first legs of spot/forward swap transactions,

Info

For more information on transaction types, see topic FX Transaction Types.

- In the Misc. area, select the Search Opposite Pair option, if you want to select the transactions with the opposite currency pair too.

If you selected the EUR/USD pair (euro as the main currency and dollar as the secondary currency) in the General tab, this tab enables you to select the transactions with the USD/EUR direction too.

- Click the following buttons, as needed:

- OK to validate the setup and go back to the management page for Spot Exchange Transactions,

- Cancel to go back to the management page for Spot Exchange Transactions without saving this setup.

For more information on the application, modification and deletion of filters, see topic Filters.